LUMA ASIA PASS

Your Travel Insurance to Asia

- Covers Covid-19

- Regional coverage

- Purchase Online

Zone 1 Countries

- Brunei

- Cambodia

- Indonesia

- Laos

- Malaysia

- Myanmar

- Philippines

- Thailand

- Vietnam

- Bangladesh

- Bhutan

- East Timor

- India

- Nepal*

- Pakistan

- Sri Lanka

Zone 2 Countries

- Brunei

- Cambodia

- Indonesia

- Laos

- Malaysia

- Myanmar

- Philippines

- Thailand

- Vietnam

- Bangladesh

- Bhutan

- East Timor

- India

- Nepal*

- Pakistan

- Sri Lanka

- Singapore

- China

- Mongolia

- Hong Kong

- Macau

- Taiwan

- Japan

- Maldives

- South Korea

*Nepal: Any trekking or mountain climbing activities are excluded.

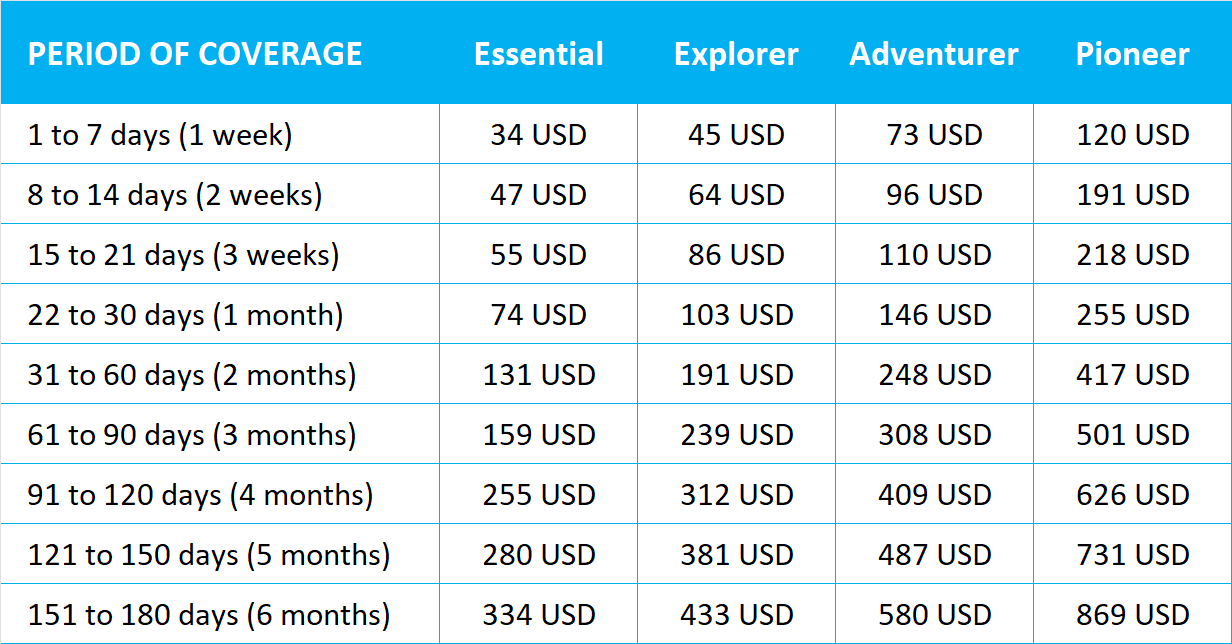

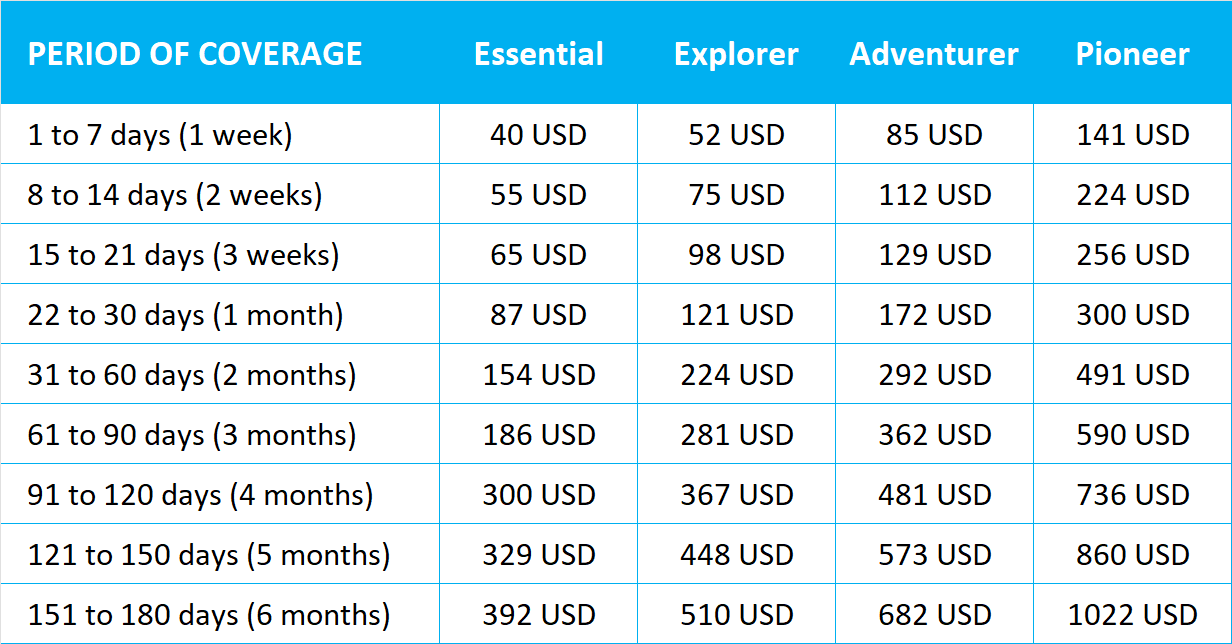

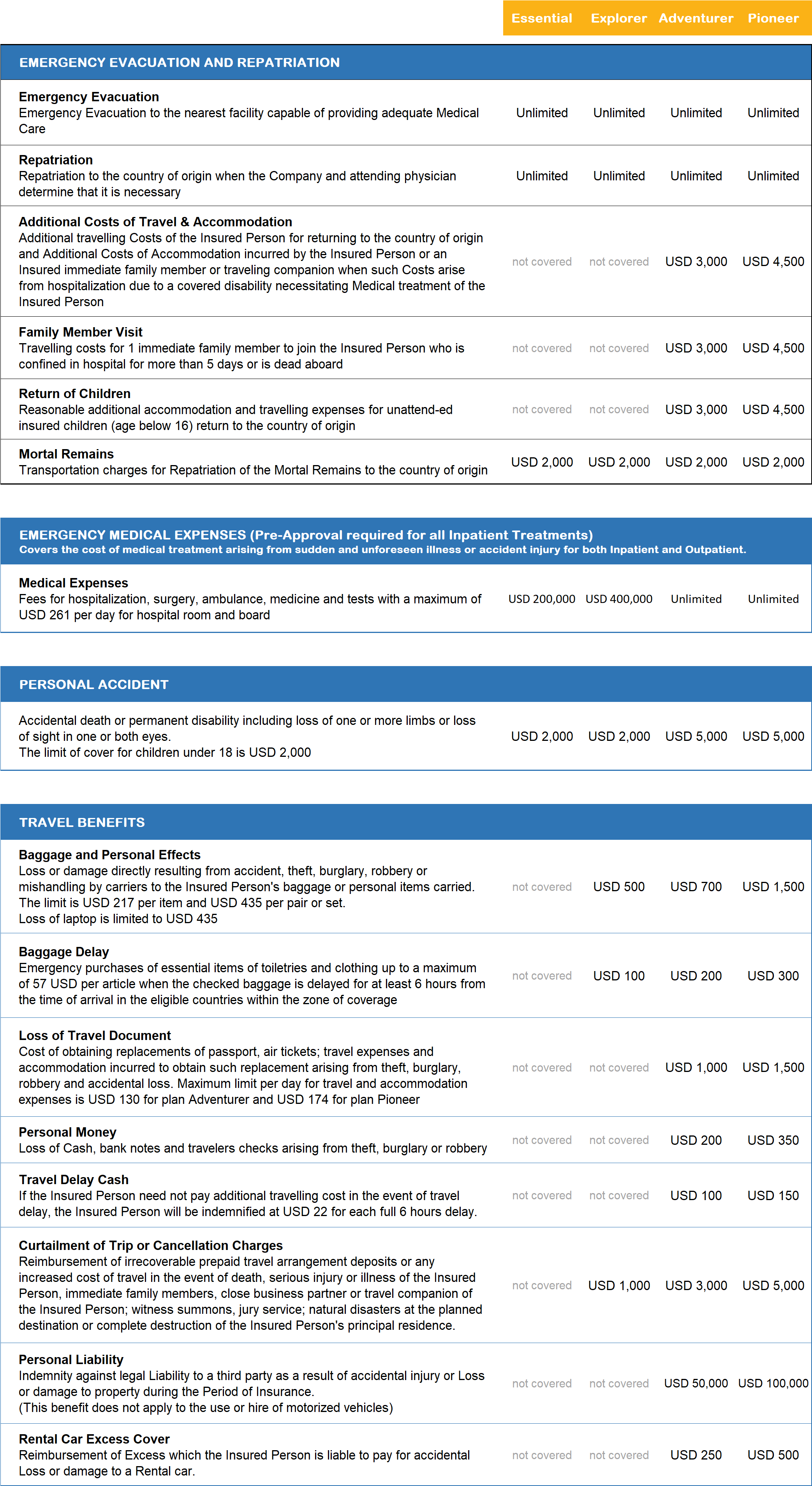

Table of Benefits

Terms and Conditions:

The Table of Benefits is only a summary of benefits and does not include full terms, conditions and exclusions. Sub-limits may also apply. Please read the Policy Wording before buying a travel insurance policy to ensure the policy suits your needs. The policy must be bought before your trip starts. Events that were anticipated at the point of purchase will not be covered.

- The earliest policy start date shall be the purchase date, not before.

- The maximum period of insurance for this Policy shall be 180 consecutive calendar days.

- Applicants must be aged from 4 weeks to 75 years old.

- Children under the age of 7 years old must be accompanied by an adult who is also insured under the same Policy.

- The sum insured for Personal Accident for children under 18 years old shall not exceed USD 2,000.

- Policy holders shall submit claims within 6 months after occurred date of the claims.

- There is no direct billing for medical expenses unless the expenses exceed USD 1,000 and that the arrangement is coordinated by the Insurer or its designated assistance company.

- This policy does not cover preexisting conditions, general exclusions nor medical expenses exclusions as stated in the Policy Wording.

- The zone of coverage of LUMA Asia Pass refers to the countries eligible for coverage as stated in the Certificate of Insurance. You will be covered during your insurance policy period for regional or multiple trips within countries included in the zone of coverage.

- This Policy is only valid for leisure travel or business travel (limited to administrative and non manual works only) and NOT cover for travel to any of the countries within the zone of coverage to seek for medical treatment.

- In case the Insured’s country of origin is one country within eligible zone of coverage, the Policy does NOT cover for any losses or expenses arising from the country of origin of the Insured.

- In case the Insured would like to purchase another policy after first policy expires, there shall be no gap in coverage and total duration of coverage of all policies combined shall not exceed 180 days.

- Policy holders reaching 76 years old during the policy are not eligible to purchase a new policy.

- Any event or condition that occurred before the new policy start date is considered pre-existing and the Insured is not able to claim for any of these conditions under the new policy. Should the Insured be actively treated or under the supervision of a Physician or Surgeon, the Insured is not eligible to purchase another policy.

Contact us today

Crafted and Serviced by LUMA

Our goal is to be your companion for all things travel and we strive to make insurance easy, accessible and ethical.

Insured by Baolong

With over three decades of expertise across a diverse range of insurance services, Baolong ensures your claims are covered.

Assistance by Europ Assistance

Europ Assistance is a leading assistance company with an international network ensuring a reliable support worldwide.